In one of those weird Facebook discussions, a very important (relative to the rest of Facebook) question came up:

![]() After a few quick Google searches, I had the answer: 44 million donkeys to 20 million grapefruit, so about 2.2 to 1.

After a few quick Google searches, I had the answer: 44 million donkeys to 20 million grapefruit, so about 2.2 to 1.

Now, those stats were from 1996, because I only spent 4 minutes on the research (it’s not like it was pirates versus ninjas or anything) but it’s worth noting that the internet has gotten to a point where one can find out the ratio of donkeys to grapefruit in under 5 minutes (and I’ve just made it that much quicker with this post. You’re welcome.)

Of course, that’s market research about 1996 like it actually is 1996. These days, there are many more tools at our disposal.

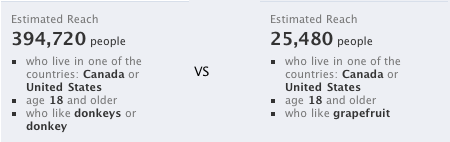

My favourite, hands down, for a ballpark estimate of a potential market, is the Facebook Ad builder. Let’s see the ratio of people who are interested in donkeys versus people who are interested in grapefruit:

There are a lot of things about this research that’s pretty dumb. Normally I’d be trying to sell something, so my demographics would be a lot tighter, and I’d have a much richer range of keywords. If I was setting up an ad campaign, I’d have multiple segments based on individual avatars I’d created, and each segment would have a different reach and ultimately different conversion percentages. And so on.

There are a lot of things about this research that’s pretty dumb. Normally I’d be trying to sell something, so my demographics would be a lot tighter, and I’d have a much richer range of keywords. If I was setting up an ad campaign, I’d have multiple segments based on individual avatars I’d created, and each segment would have a different reach and ultimately different conversion percentages. And so on.

All that said, those numbers took less than a minute to pull up. And they’re tied to a clearer course of action towards the next step, which is generating some traffic around a test offer, building a list, and so on.

Someone’s probably done some research on this, and I suspect it’ll vary by market, but there’s got to be a semi-reliable multiplier to figure out, based on the potential Facebook audience, what the potential real life market size would be. This is where Facebook is going to get more and more valuable as they crank up the data gathering – assuming, of course, that they don’t start to drop relevance in favour of increasing impressions, but if they did the multiplier would just drop.

So that’s market research, 1996 and 2011 style. Now what’s 2015 going to look like and how can we get there ahead of schedule?

Leave a Reply